source: Samuelson

1. Use Backtesting

Backtesting is when you look at historical data to simulate how an edge has fared historically.

One of the biggest mistakes traders make, is that they don’t know the odds of success for a trade before they enter it. They use their trading indicators and technical analysis setups to find profitable trading entries, and believe that the market will behave in a certain way since this or that indicator showed some good readings.

The truth is that very little of the technical analysis that’s out there works! Technical analysis in itself is merely a tool to quantify and describe market behavior. And as with any behavior, there is bad and good behavior.

In today’s markets, edges are becoming ever harder to find. The competition is increasing, and you have to step up your game if you want to make money!

Considering that most traders don’t use backtesting, starting to backtest your ideas could very well be classified as a trading hack. It will give you a great advantage over your competitors, and you’ll be able to quickly separate the wheat from the chaff!

Still, this trading hack isn’t foolproof. Designing your own trading strategies could easily lead to curve fitting, which means that the strategy seems to work, but just is the result of fitting your rules to random market noise!

2. Go With Higher Timeframes

The next trading hack is all about the time frame. Many beginners are really keen on trading on low timeframes, such as 5 or 10 minute bars. The fast-paced market action gives the impression that money can be made quickly if you just manage to time those reversals that are so apparent with hindsight!

The fact is that the lower the timeframe you use, the harder it gets to find an edge. The random noise, which is always present, increases in intensity with lower timeframes. This means that much more of the price action in five-minute bars is random, than that of daily bars for example. Higher timeframes include more market action, and average out some of the market noise so that it doesn’t distort the image as much.

This is why we actually recommend that you go with daily bars. Representing one trading day, daily bars are used to a much greater extent by market players, than for example five minute bars. In other words, more decisions are made based on where the daily price goes, which in itself also helps with limiting the randomness in those timeframes.

In our experience, trading systems based on daily bars are more robust, and tend to be harder to curvefit than those built on lower timeframes!

3. Don’t Look at Trades With Hindsight!

If there was a trading hack that could make you mentally stronger and more focused than your competitors, then you probably would be very interested!

Well, not looking at trades with hindsight is one of those trading hacks that could give you this very advantage!

Many traders spend their time looking at what they could have done. They wish that they held a trade for longer than they did, or went out right before the market lost 5% in two bearish days.

These traders focus on what as happened, and aren’t solution-driven. Instead of trying to improve their trading skills they cherish in the thought of how much money they could have made, and forget what is important, namely to evolve and continue to improve for the future!

4. Don’t Look at the Single Trade!

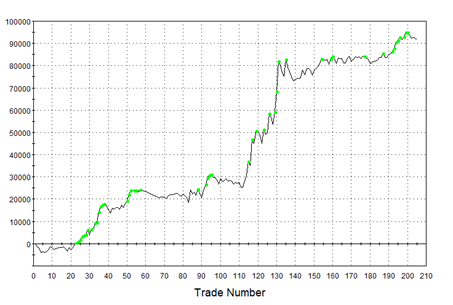

Many traders haven’t understood that trading is completely random at the single trade level, but becomes a game in your favor when many of those trades are put together.

Put differently, anything could happen to a single trade. It could be a loss, a win, or produce breakeven results. However, if you have a trading strategy that works, these random trades added together will give you an edge in the market. You just don’t know when the losses or wins are going to occur. It could very well be this trade, or the coming one, or the one after that that brings the profits!

In other words, it’s useless to analyze your results based on one single trade! You need several, and preferably hundreds to draw any robust conclusion!

5. Keep Preserving Your Capital Your First Priority!

One of the biggest mistakes made by traders is to take on excessive risk in hopes of reaping quick rewards.

Actually the right mindset is not one where maximizing profits becomes the main priority, as you might assume. Trading is a marathon, that needs to be endured for a long time. Those going for short sprints indeed can make a lot of money, but will eventually end up losing it all due to one big blow!